Nomination is a simple yet very important aspect of your banking. It guarantees the handover of your hard-earned wealth to its legal heir. Banks are the custodian of our money who, along with facilitates the seamless platforms to conduct our day-to-day transactions or business activities and pay some interest amount for keeping our money with them.

But many customers either ignore the importance of nomination or are not aware of such facilities in a Bank. In the absence of nomination, it becomes very difficult for your loved ones to claim the money which is being held in the bank account. The task to claim that wealth is time taking, expensive and difficult as it involves the legal processes to obtain succession certificates/letter of administration/probate of the will.

Who is a Nominee?

A nominee is simply the person who receives the benefit in case of the death of the insured person. And, the act of choosing someone to receive the benefits or wealth or money is called the nomination.

The Banking Regulation Act (1949) under the provisions of Section 45 ZA states that the deposit would be refunded to the nominated person and once nomination is made in respect of one deposit then the same will hold good for other deposits with the same branch of the Bank.

The Supreme Court of India (SC) had indicated that the nominee is only the custodian who is authorized to receive the amount. The insurer is discharged of his liability under the policy on making payment to the nominee.

Below could be your nominees:

- Nomination has to be made in favour of family members i.e., spouse/minor child/parents/siblings etc.

- Nomination can be made in the name of any other person if there is no family member e.g., friends or partner.

- The member can decide how much share of his entitlement to be distributed in nomination form itself according to his choice. In the bank accounts or fixed deposits, you can have only 1 Nominee with 100% entitlement. Whereas in Mutual Funds and other investments you can have up to 3 persons nominated with differential shares of the proportion.

- A legal heir certificate will be required to prove your claim in case no family member has been nominated.

What is the nomination process?

When you are going to open a Bank account with any of the Bank, there is an option of providing the nominee’s name in the account opening form itself. As a best practice, it is suggested that you fill the entire form in your handwriting only, in order to avoid any misinformation or typo errors in your crucial information at the bank.

But sometimes Bank official’s offer their help to fill out the lengthy and complicated form for you and you just have to sign it to validate the details being filled in the form. In such cases, please fill the nomination column at least in your handwriting.

The same applies to fixed deposits which you open with the Bank or Post offices, wherein, you will find the nomination column in the form itself to be filled.

Note: There is no linkage between the nominee in your bank account and fixed deposits. You can have different nominees in your bank account as well as your individual Fixed Deposits. For example, in the bank account, you can nominate your wife as the nominee, in Fixed Deposit No. 1, you can nominate your father, in Fixed Deposit No. 2, you can nominate your mother and so on.

What happens, if there is no nominee in an already opened bank account or Fixed deposit?

After reading this blog, immediately review details with regards to nomination in all of your Bank accounts, Fixed deposits and Investments. Make sure that the below points should meet for your nomination facility:

- Nominee name is present.

- Nominee name should match with the (valid) Govt. issued ID card of the nominee e.g., Aadhaar Card or Election Card or Passport. Look out for spellings as well, there should not be any grammatical error in any of the detail updated in your bank account.

If you find any variance in your nomination data from the above-mentioned points, then without any further delay reach out to your Bank for availing this free yet crucial facility.

There are 3 important forms used for nomination facility across all the banks i.e., Form DA-1, Form DA-2 & Form DA-3. Let’s understand them one by one:

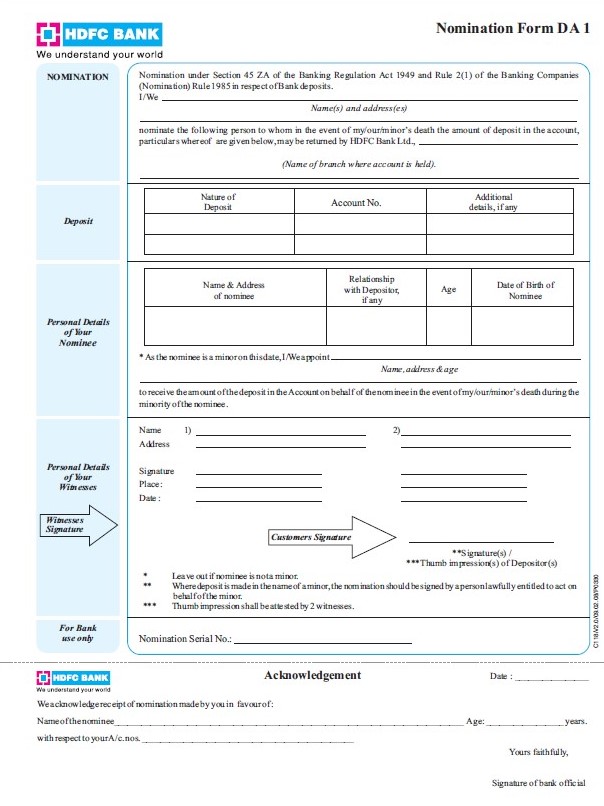

Form DA-1: Nomination Form

Form DA-1 is used for fresh nomination in the bank accounts and fixed deposits with a Bank. If you find that the nominee name is missing, after reviewing your financial records then this is the form for you. Below-mentioned is the sample of Form DA-1.

For Fresh Nominations in Bank account and Fixed Deposits.

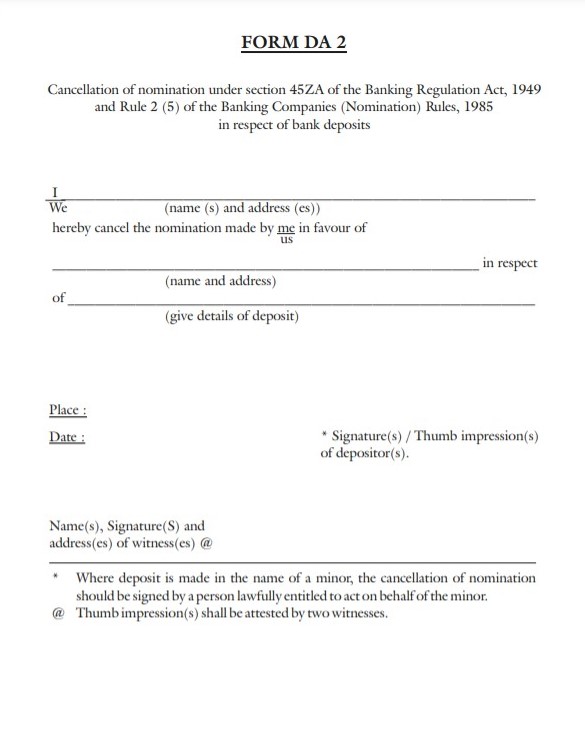

Form DA-2: Nomination Cancellation Form

However, this is the least important form because it is being used to cancelling the nomination from the accounts. But, if someone still wants to cancel a nomination from the account then this form could be used.

Nomination Cancellation form.

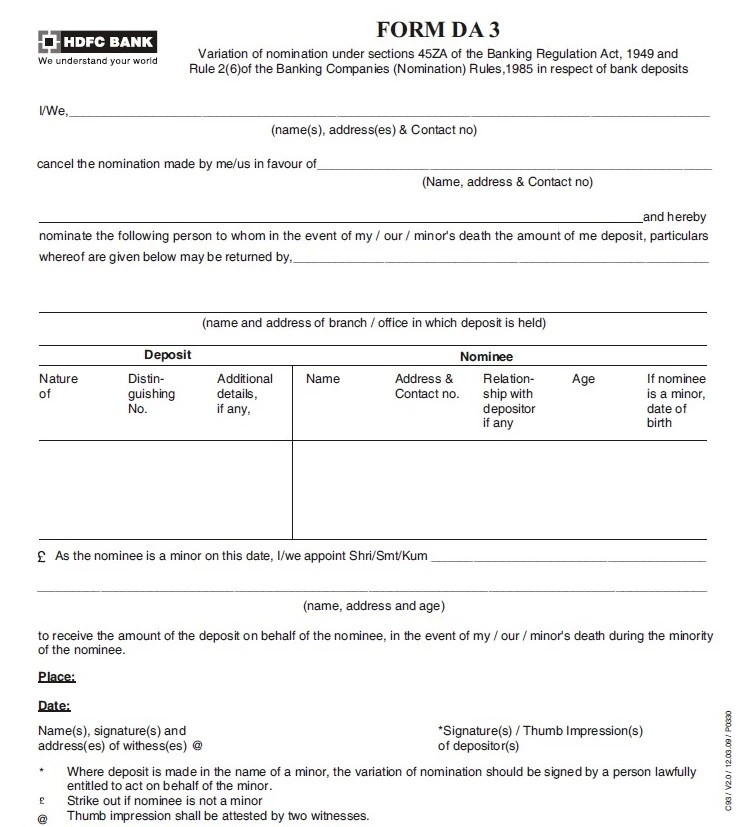

Form DA-3: Nominee Modification Form

If you find that there are grammatical errors in your existing nominee details or if you have changed your mind to nominate some other person from the existing one, then Form DA-3 has to be filled.

A nominee can be changed several times during the lifetime of the holder of the bank account. Generally, it takes 2 working days to update your nominee details within any Bank so one can change the nomination multiple times. There are no charges for this facility and no Bank or Financial institution can deny you from availing of this facility.

Form DA-3 for Nominee modification.

Conclusion

So, what you are thinking? Review your financial records and set this thing right immediately to save your loved ones from getting into the complexities of claiming their rightful money, when you were not around. With this simple task of adding a nominee, you can guarantee the transfer of benefits to its rightful owner after your death without any hassles.

Also, if you have written a Will which is registered under the court of law then you need not worry because as per The India Succession Act, 1925 a registered Will supersedes all other kinds of nominations. But, registering a Will is a bit more complicated (and involves legal expenses) than going for a nomination facility (which is free).

Download the various Nomination forms for leading private and government banks of India, to update your nominee details and safeguarding your hard-earned wealth.